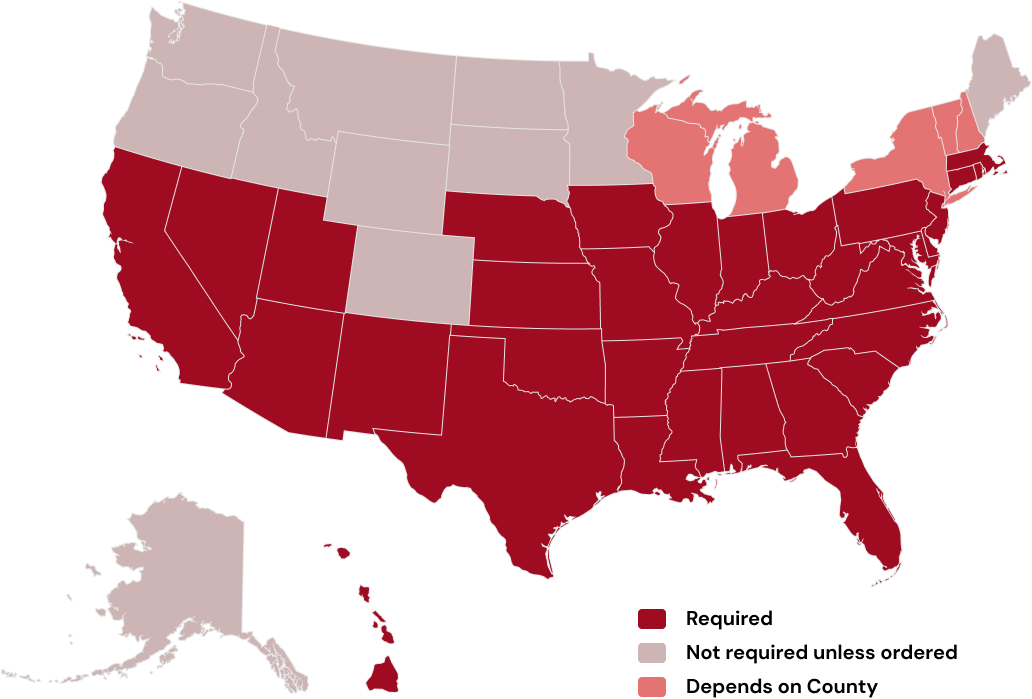

Are you a service member, veteran, or part of a military family seeking a safe, sound, and sanitary home through the VA home loan program? Ensuring your prospective property is termite-free is as crucial as meeting other essential homeownership requirements. Join us as we explore VA termite inspections by state, discovering where these inspections are […]