With the mortgage market in such a volatile state, it is important to be aware of all your options for purchasing a new home. A buydown is one such option, and uniquely applicable for the rates in today’s environment.

A buydown is a mortgage option where the payment is reduced temporarily as if the rate was "bought" down for the first 1-3 years of the loan, depending on the type of buydown. With a buydown, homebuyers are able to purchase their homes with lower monthly mortgage payments to start.

There are several reasons why one would use a buydown. Sellers trying to attract potential homebuyers in this market, or a buyer expecting their annual income to increase or rates to go down, in the next few years, being the most common.

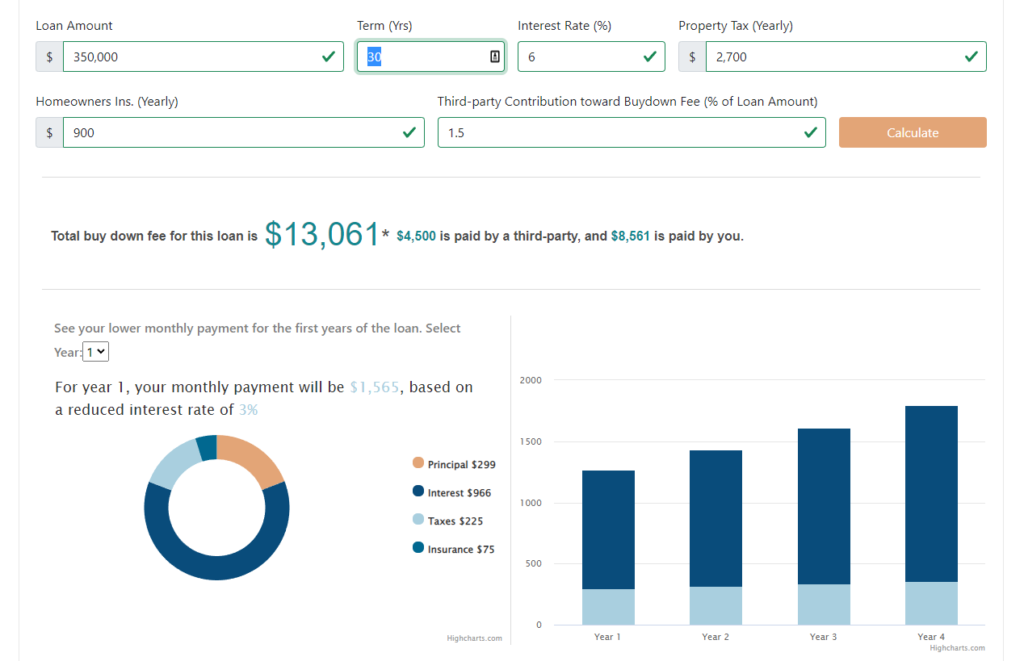

Let’s use the example of a 350,000 loan with a 6% rate and a 3-2-1 buydown. The principal and interest payment for the loan will be 1798.00/mo. Now, in the first year of the 3-2-1 buydown, the interest rate will be 3%, with a monthly payment of 1265.00/mo, while the remaining 533.00/mo will come out of the “temporary buydown” escrow account that is seller-funded at the time of closing. This will continue into year 2 and year 3 with the amount coming from the buyer increasing and the amount coming from the escrow account decreasing. Then from year 4 to year 30, the borrower will pay the full principal and interest payment. There is no additional charge to the buyer to take advantage of this program.

Click the link below to see what your payments could look like for the buydown period and beyond, as well as the amount that will be funded to the “temporary buydown” escrow account.

In simplest terms, when you close your loan, funds are placed in a separate account and used to pay a portion of your monthly payment for the first 3 years of the loan. This means you can take advantage of the savings to fix up the house you just bought, and if rates improve in the future, you are encouraged to refinance to fix a lower rate and payment.

As with any mortgage product, it is important to understand how it works, the risks involved and if it will benefit you. Being an informed buyer ensures that you are making the right choices for yourself. Reach out today to find out if this or other programs we offer cab help you on your way to becoming a homeowner!

Instant notifications for your scenario

Let's do it⏰ Your offer will be delivered to your inbox in less than a minute!